China Capital Gain Tax when changing WFOE’s owners

#ChinaCapitalGainsTax #ChinaDividendTax #ChinaDTAwithUSA

Evershine affiliates, with global hands-on experiences , consult you to adopt tax-saving option when changing shareholder of your subsidiary in China.

Contact us by email:

E-mail: sfo2cn@evershinecpa.com

Answer:

This plan is referred to here asA Proposal.

Step 1:

First, let GZ-C Company decide to distribute a dividend of 19 million yuan, and GZ-C Company’s shareholders’ equity is reduced to 15 million RMB, which is the original investment of 10 million RMB plus the statutory capital reserve of 5 million RMB.

According to the tax laws of mainland China, if a dividend of RMB 19 million is distributed to an overseas non-resident enterprise, GZ-C Company is the withholding agent and the withholding tax rate is 10%.

However, if an overseas non-resident enterprise is located in a country that has signed a double taxation agreement with China, a preferential tax rate will apply.

For example: If the Mainland and Hong Kong sign a tax agreement, the withholding income tax rate is 5%.

*Please note: The payment date for withholding tax is the actual dividend payment date, not the shareholder decision date.

Step 2:

GZ-C company then goes through the procedures to change its foreign shareholder HK-A to HK-B.

The transaction price is 15 million RMB, which is the original investment of 10 million RMB plus the statutory capital reserve fund of 5 million RMB.

In this case, HK-A will receive a capital gain of RMB 5 million. 5 million RMB is subject to 10% capital gains tax (=500,000 RMB).

useA Proposal Total tax paid

step 1 + step 2 = 1.9 million RMB + 500,000 RMB = 2.4 million RMB

Stamp tax:

Transferor HK-A Company pays equity. If the transferee is HK-B Company, it must also pay 0.0005% of the transaction amount. Assuming that the transaction price is 15 million RMB, the stamp tax is 1500RMB=750RMB+750RMB

CIT-015

On the day GZ-C Company decides to distribute dividends 24 millions RMB to Company HK-A , does it need to be withheld 10% tax immediately? Which unit does it need to report to? Tax regulations?

Answer:

The date when the dividend is actually paid is the date when the withholding tax is paid.

Dividends can be distributed in installments and withheld in installments.

In the quarter in which the dividend payment date is determined, a declaration can be made to the tax bureau under the jurisdiction of the enterprise.

Apart from this, no other government units need to declare.

According to Tax regregulation:

State Administration of Taxation

Announcement on issues related to source withholding of corporate income tax for non-residents

State Administration of Taxation Announcement No. 37 of 2017

Answer:

This plan is referred to here as B Proposal.

According to Chinese tax laws, the income tax that will generally be levied is as follows:

The transferor is HK-A company and the transferee is HK-B. The taxes involved include:

a. Income tax on the sale of corporate equity by HK-A:

the difference after deducting the net assets from the transaction amount. Non-Chinese tax resident enterprises shall pay 10 % tax calculation, HK-A Hong Kong company is a non-Chinese tax resident enterprise.

Assuming that the transaction price is 34 million RMB, HK-A company’s stock exchange price is 24 million RMB*10%=2.4 million RMB.

b. Amount of withholding tax on dividend distribution:

If GZ-C distributes 19 million dividends to HK-B after transfer, the withholding tax amount is 10% = 1.9 million RMB.

The total tax amount is equal to 4.3 million RMB = 2.4 million RMB + 1.9 million RMB.

B Proposal, comparing with the above-mentioned A Proposal, you will pay an extra 1.9 million RMB,

so if the situation permits, you should choose A proposal .

Stamp duty:

The transferor, HK-A, pays 50,000% of the equity transaction amount, and the transferee, HK-B, also pays 50,000% of the equity transaction amount.

Assuming that the transaction price is 34 million RMB, the stamp duty is 3400RMB=1700RMB+1700RMB.

Detailed calculation and tax declaration details of China’s tax laws :

Equity transfer income refers to the equity transfer price minus equity costs The difference after the price.

Equity transfer price refers to the amount received by the equity transferor for the transferred equity, including cash, non-monetary assets or equity.

If the held enterprise has undistributed profits or various funds with after-tax deposits, etc., the amount of the shareholder’s retained earnings rights transferred by the equity transferor together with the equity shall not be deducted from the equity transfer price.

The equity cost price refers to the amount of capital actually delivered to the Chinese resident enterprise by the equity transferor when investing in the equity, or the equity transfer amount actually paid to the original transferor of the equity when purchasing the equity. Article 37 of the “Enterprise Income Tax Law” stipulates that the income tax payable by non-resident enterprises on the income specified in paragraph 3 of Article 3 of this Law shall be withheld at source, and the payer shall be the withholding agent.

In this example, GZ-C Company is the withholding agent.

If the income obtained by a non-resident enterprise is the income from equity transfer, according to the second article of the original Guo Shui Han [2009] No. 698, the non-resident enterprise shall start from the date of equity transfer as stipulated in the contract or agreement (if the transferor obtains the equity transfer income in advance) , should report and pay corporate income tax to the competent tax authority in the place where the income occurs within 7 days from the date of actual income from the equity transfer. This provision is the interpretation of the State Administration of Taxation’s “Announcement of the State Administration of Taxation on Issues Concerning the Withholding of Income Tax at Source for Non-Resident Enterprises”.

For details, please see https://www.chinatax.gov.cn/n810341/n810760/c2878586/content.html

CIT-030

In the above situation, HK-B Hong Kong Company owns GZ-C Guangzhou Company. When GZ-C Guangzhou Company distributes dividends to HK-B Hong Kong Company in the future, due to the previous equity transaction, HK-A Hong Kong Company paid Can the income tax on equity transactions be deducted ?

Answer:

GZ-C Guangzhou Company, after the conversion of foreign shareholders, distributes dividends to the succeeding company, in this case HK-B Hong Kong Company, it still needs to withhold 10%.

Previously, due to equity transactions, the equity transaction income tax paid by HK-A Hong Kong Company could not be deducted. Therefore, if GZ-C Guangzhou Company does not first distribute dividends to HK-A and then transfer it, the entire group will eventually have to pay 10% twice, totaling 20% in short period.

Only when HK-B Hong Kong Company transfers its GZ-C equity or liquidation, due to the investment cost increase, and there will be no problem of paying 10% twice. That means only time difference incurred, not a permanent difference.

Answer:

The competent authority is: Guangdong Provincial Administration for Market Regulation https://www.gdzwfw.gov.cn/portal/v2/guide/11440000MB2D0234372440125017038

(Application window) Guangzhou Tianhe Window No. 1 to 7 of the registration hall on the second floor of No. 57 Tiyu West Road, District)

List of materials that need to be prepared:

1. “Company Registration (Filing) Application Form” 2. If the change of registration matters involves the modification of the company’s articles of association, submit the modification of the company’s articles of association Resolutions and decisions (where registration of shareholder change does not require submission of this document, if the company’s articles of association provide otherwise, such provisions shall prevail) 3. If the change of registration involves modification of the company’s articles of association, the revised company’s articles of association or amendment to the company’s articles of association shall be submitted and submitted by The company’s legal representative signs and confirms the company’s articles of association or amendments to the company’s articles of association 4. Relevant supporting documents for the change 5. If laws, administrative regulations and decisions of the State Council stipulate that company changes must be submitted for approval, submit a copy of the relevant approval document or license 6. Return the original and copy of the paper business license that has been collected

CIT-050

Company GZ-C has accumulated profits of RMB 24 million over the past few years.

Company GZ-C wants to distribute dividends of RMB 19 million to Company HK-A.

Can the tax agreement between Mainland China and Hong Kong be applied and a preferential tax rate of 5% be adopted?

Answer:

If the tax agreement between the Mainland and Hong Kong applies, a dividend of RMB 19 million can be distributed before the equity transfer, and the dividend is calculated as 5%.

But the prerequisite is that the HK-A company must be a tax resident (COR: Certificate of Resident) with substantial operations in Hong Kong.

According to the “Arrangements between the Mainland and the Hong Kong Special Administrative Region on Avoiding Double Taxation and Preventing Tax Evasion on Income” issued by the State Administration of Taxation on November 21, 2019, if a Hong Kong company, as a dividend beneficiary, directly holds more than 25% of the shares of a domestic company , the dividend tax is only 5% of the total dividend amount.

The prerequisite for enjoying tax incentives is that it must meet the conditions stipulated in (Guo Shui Han [2009] No. 81), including:

1. Hong Kong companies must obtain a tax resident identity certificate;

2. Hold domestic companies for 25 consecutive months before receiving dividends. % or above of the shares;

3. Submit an application for tax reduction or exemption to the competent tax authority and pass the review.

In other cases that cannot meet the above conditions, it is 10% of the total dividend.

Assuming that HK-A company is a non-substantial operating company and cannot obtain a Hong Kong company that needs to obtain a tax residency certificate (COR: Certificate of Resident), 10% will be applied. 1.9 million RMB.

Taking HK-A company as an example, if it meets the conditions for tax exemption and exemption under the tax agreement between the Mainland and Hong Kong, if it distributes dividends of 19 million before the equity transaction, the tax rate is 5% = 950,000 RMB, which can be reduced by 950,000 RMB.

CIT-060

A Guangzhou company, referred to as GZ-C company, repatriates dividends to its parent company in Hong Kong.

It requires Hong Kong and Mainland China to have an agreement to avoid double taxation.

According to the bilateral agreement, 5% is applied for repatriating dividends.

Preferential tax rate, which tax bureau should I go to apply for? Website?

Answer:

Non-resident taxpayers enjoy the benefits of double taxation arrangements signed between the Mainland and the Hong Kong and Macao Special Administrative Regions in accordance with the State Administration of Taxation Announcement No. 60 of 2015 “Measures for the Administration of Tax Agreement Benefits for Non-resident Taxpayers” https ://www.gov.cn/gongbao/content/2016/content_5038098.htm

Non-resident taxpayers who meet the conditions for enjoying the benefits of the agreement can enjoy the benefits of the agreement themselves when reporting tax, or through the withholding agent when reporting tax. treatment and accept follow-up management by the tax authorities.

Non-resident taxpayers refer to taxpayers (including non-resident enterprises and non-resident individuals) who are not tax residents in China according to domestic tax laws or tax agreements.

Non-resident taxpayers who enjoy tax treaty permanent establishment dividends must submit relevant report forms and materials when making their first tax return in the relevant tax year, or when the withholding agent makes their first withholding return in the relevant tax year.

Taxation Bureau Online Application :

Non-resident taxpayers declare to enjoy treaty benefits https://www.gdzwfw.gov.cn/portal/v2/guide/11440000006941354C244042406300101

Guangzhou Municipal Taxation Bureau: No. 767 Huacheng Avenue, Tianhe District, Guangzhou Tel. 020-12366 – 4-2

CIT-070

Hong Kong COR certificate of Resident Which agency should I apply to?

Answer:

Hong Kong Inland Revenue Department (IRD) https://www.ird.gov.hk/chi/welcome.htm

Hong Kong Tax Resident Certificate (Applicable: Company Form) form link https://www.ird.gov.hk /chs/pdf/ir1313a_c.pdfSubstantial

operations usually include the following elements:

having a fixed business location in Hong Kong;

employing a sufficient number of suitable employees in Hong Kong;

generating sufficient operating expenses in Hong Kong;

making necessary management decisions in Hong Kong and Bear corresponding operational risks.

CIT-080

A Hong Kong parent company HK-A receives dividends from its subsidiary GZ-C in Guangzhou, Mainland China, will the Hong Kong parent company HK-A be regarded as Hong Kong income by the Hong Kong Inland Revenue Department and be taxed?

Answer:

No. According to Hong Kong’s <<Inland Revenue Ordinance>>

https://www.ird.gov.hk/chi/tax/bus_pft.htm#a01

, the scope of profits tax is any person, including a corporation , partnership, trustee or A body carrying on a trade, profession or business in Hong Kong and deriving from such trade, profession or business any assessable profits arising in or derived from Hong Kong ( other than profits from the sale of capital assets) is subject to tax.

In this case, the dividend income received by the Hong Kong company from its mainland subsidiary actually came from mainland China, not from Hong Kong, nor was it generated in Hong Kong. Therefore, it will not be levied profits tax in Hong Kong.

CIT-090

What are the dissolution and liquidation procedures of Hong Kong company HK-A?

Answer:

A “limited company” can be wound up.

A limited company is a company incorporated under the Companies Ordinance and is an independent legal entity (that is, it can sue others or be sued).

A limited company will go through the legal process of “liquidation” to sell off all its assets to pay off its debts and eventually wind up the company.

Data source: Hong Kong Government One Stop

https://www.gov.hk/tc/business/supportenterprises/businesstopics/windingup.htm

Overview of the liquidation process

You can get a preliminary understanding of the liquidation process (except voluntary liquidation) through the following flow chart: Step1:

Issue a debt repayment demand to the relevant company

Step2:

Submit a winding-up petition to the court, the Official Receiver’s Office and the relevant company (Note)

Step3 :

Court hearing

Step 4:

The court issues a winding-up order

Step 5:

A meeting of all creditors (i.e. “creditors”) and other relevant parties

Step 6:

Appointment of a liquidator

Step 7:

Sale of the company’s assets and distribution of funds to creditors

Step 8:

Discharge of the liquidator

Step 9 :

Dissolution of a company

( Note: The winding-up process officially begins when the petition is submitted )

https://clic.org.hk/en/topics/bankruptcy_IndividualVoluntaryArrangement_Companies_Winding_up/companies_Winding_up/What_kind_of_companies_can_be_wound_up

CIT-100

Can Hong Kong companies HK-A and HK-B merge?

Answer:

With the introduction of the court-free merger mechanism

under the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) (the “Companies Ordinance”) , the merger of Hong Kong companies can be implemented in a more cost-effective and straightforward manner .

Today, court-free mergers (“mergers”) are a popular method for groups to streamline their structures and operations in Hong Kong .

There are two types of mergers without court in Hong Kong:

1. Horizontal merger: the merger of two or more wholly-owned subsidiaries of the same holding company ; and

2. Vertical merger: a holding company and one or more wholly-owned subsidiaries of the same holding company. Merger of subsidiaries .

Whether it is a horizontal merger or a vertical merger, the relevant regulations and procedures of the Hong Kong Chinese Orchestra must be followed; in particular, each company after the merger must be a joint stock limited company registered in Hong Kong .

Key issues to consider when amalgamating:

If any of the merging companies holds any interests in other foreign entities, or has any overseas offices, properties or businesses, or ( in the case of a horizontal merger) the holding company of the merging companies is not a Hong Kong company , or if there are other circumstances in which a foreign company may be involved.

In this example, Company HK-A is a non-Hong Kong tax resident company with no substantial operations, and can only be merged into Company HK-B, which is a non-Hong Kong tax resident company with substantial operations.

If there is a merger, GZ-C Guangzhou Company, if the name of the foreign shareholder changes, there is still the risk of being taxed 10% of the RMB 2.4 million gained from the investment transaction.

This merge solution is not recommended.

CIT-110

If a U.S. company USA-D receives dividends distributed by a Guangzhou company, does it need to pay income tax after they are recorded? Can the income tax and 10% dividend withholding tax paid by the subsidiary in Guangzhou, mainland China, be deducted?

Answer:

The United States enacted relevant laws and regulations on controlled foreign companies (CFC), Subpart F, in 1962.

LB&I International Practice Service Concept Unit

https://www.irs.gov/pub/int_practice_units/RPWCUP8_03_01.pdf

LB&I International Practice Service Transaction Unit

https://www.irs.gov/pub/int_practice_units/TRE945009_01.pdf

The purpose of defining CFCs in the statute and explaining their income recognition and taxation methods is to prevent U.S. taxpayers (including individuals and businesses) from using CFCs to obtain income tax deferred benefits, that is, when the invested CFC has undistributed earnings in the current year, it will be deemed Taxes and taxed as income, rather than waiting until dividend distributions are received.

CFC means that more than 50% of the equity of a non-U.S. company is held by U.S. shareholders, and each U.S. shareholder holds at least 10% of the company’s equity.

Subpart F income is divided into three broad categories:

(1)FBCSI (Foreign base company sales income) overseas business income

(2)FBC service income (Foreign base company service income) Overseas service income

(3)FPHCI (Foreign personal holding company income) overseas passive income (such as dividends, interest, rent, etc.).

There are several exceptions under FBCSI that do not require inclusion as Subpart F income.

(1) CFC’s sales revenue is generated from its own products

(2) The source of CFC’s sales revenue is in the same country as CFC, that is, the supplier is in a country other than CFC’s.

(3) CFC products are produced in the country where the CFC is located

In this case, if the Guangzhou company complies with CFC, the U.S. company needs to classify its income as Subpart F and include it in income tax every year.

The income tax paid by the Guangzhou subsidiary in that year can be used as a credit in the same year.

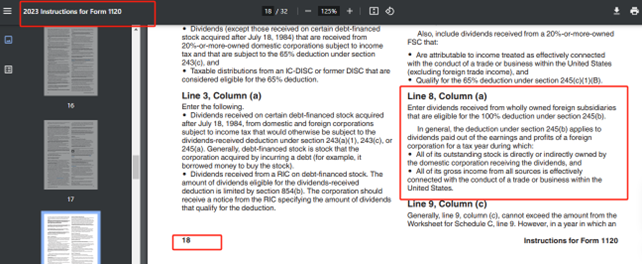

When the U.S Company received dividends distributed by the Guangzhou subsidiary, they can deduct the dividends in full, which is equivalent to tax exemption.

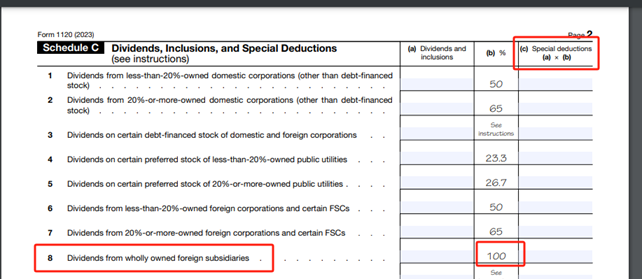

When a U.S. company receives a dividend, it must include the dividend as income and include the dividend as a deduction in Schedule C:

The U.S. income tax return (Form 1120) is as follows:

CIT-GZ-120

Hong Kong subsidiary HK-B, a 100%-owned subsidiary of an American company, received dividends from GZ-C, a 100%-owned Guangzhou company. Is this dividend considered Subpart F income for the American company?

Aanswer:

There is an exception under FPHCI called “look through”.

If the overseas passive income obtained by the CFC from the related party is derived from actual operations and is not classified as the Subpart F income of the related party, the passive income does not need to be recognized.

Listed as Subpart F, this U.S. company still needs to determine whether HK-B’s own operating income complies with the requirements of Subpart F.

Please be aware below Warning:

The above contents are digested by Evershine R&D and Education Center in MAY 2024.

Regulations might be changed as time goes forward and different scenarios will adopt different options.

Before choosing options, please contact us or consult with your trusted professionals in this area.

Contact Us

E-mail: sfo2cn@evershinecpa.com

or

Contact by phone in working hours of New York time zone:

The Engaging Manager Ian Lin, a well-English speaker

Tel: +1-510-996-2685

or

Evershine Affiliates in Beijing, Shanghai, Xiamen, Shenzen etc

Manager Bing Weng, UK Master Graduate, a well-English speaker

Mobile: +86-180-5008-2372

Tel. No.: +86-592-573-4710

wechat:yaoren01522

Evershine Affiliates Information

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Phoenix, Michigan, Seattle, Delaware;

Berlin, Stuttgart;Paris; Amsterdam; Prague; Czech Republic; Bucharest;

Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please send email to HQ4sfo@evershinecpa.com

More City and More Services please click Sitemap